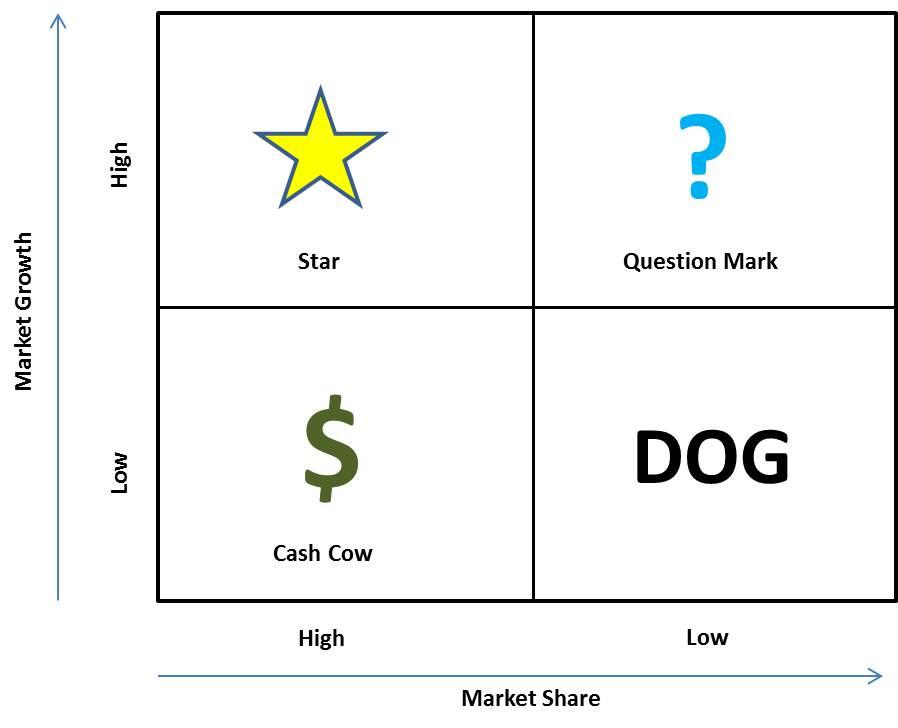

At that time, GE was operating around 150 business units and was using BCG (Boston Consultancy Group) Matrix but over the period more sophisticated tool was required to help the company in deciding for the units that actually deserved investments of funds for development. BCG Matrix Boston Consulting Group (BCG) Matrix is a four celled matrix (a 2. 2 matrix) developed by BCG, USA. It is the most renowned corporate portfolio analysis tool. It provides a graphic representation for an organization to examine different businesses in it’s portfolio on the basis of their related market share and industry growth rates.

- Bcg Matrix Of Microsoft Company Information

- Bcg Matrix Of Microsoft Company Information

- Bcg Matrix Of Microsoft

- Bcg Matrix Of Microsoft Company

The BCG matrix also called 'growth - market share'. It is a simple and intuitive tool for portfolio analysis. The availability and originality of the chart sectors names made it very popular among marketers and managers. Let’s consider the example of building a matrix in Excel.

Bcg Matrix Of Microsoft Company Info Nach Baliye 6 11th January 2014 Full Episode Check out my Blog: If you've taken business class or familiar with management consulting strategies, you've probably come across this tool called a BCG Matrix. Also known as a growth-share matrix, the BCG matrix was created by Bruce Hendersen in the 70s (founder. The Boston Consulting Group’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue or develop products. The BCG matrix, also known as the BCG growth-share matrix, growth market share matrix, or product portfolio matrix, helps businesses with the long-term planning of their products. This tool helps companies determine which products warrant discontinuing, development, or further investing.

Examples of using the BCG matrix

Using the matrix of the Boston Consulting Group (BCG) you can quickly and visually analyze the product groups and branches of the company. You can proceed company analysis based on their share in the relevant market segment and in the market growth rate. The using of the tool is based on two hypotheses:

- The leader in the market has a competitive advantage in production costs. Consequently, the leading company has the highest profitability in the segment.

- An enterprise needs to invest a lot in the development of its product to work effectively in a fast-growing market. The presence in the segment with a low growth rate allows the company to reduce this expense item.

With the help of the BCG matrix, it is possible to quickly identify the most promising and the 'weakest' goods (branches, companies). You can make a decision on the basis of the received data: what assortment group (division) to develop, and which of them needs to be liquidated.

All the analyzed elements go into one of four quadrants after the analysis work:

- 'Problems'. Products represented in fast-growing industries, but having a low market share., You need significant financial investments to strengthen their position in the market. The enterprise decides whether it has sufficient funds for the development of this assortment group or division if these directions fall into this quadrant. The product does not develop without cash injections.

- 'Stars'. Business directions and products are leaders in a fast-growing market. The task of the enterprise is to support and strengthen these products. The best resources should be allocated to them because it is a stable source of profit.

- 'Moneybags'. Goods with a relatively high market share in the slowly growing segment. They are the main generator of money and do not need high investment. It’s sales revenues should go to the development of 'stars' or 'wild cats'.

- 'Dead weight'. A characteristic feature is the relatively low market share in the slowly growing segment. These directions do not make sense.

The BCG matrix: an example of construction and analysis in Excel

Let’s consider the construction of the BCG matrix on the example of an enterprise. Preparation:

- Collect data and build the source table. A list of elements to be analyzed is made up at the first stage. It can be goods, assortment groups, company branches or enterprises. It is necessary to specify the volume of sales (profit) and similar data of a key competitor (or a number of competitors) for each indicator. The initial data is entered in the table. * The analyzed period can be different (month, quarter, half a year). But the closer this indicator to the year, the higher it’s objectivity (since seasonality does not affect the figures).

- Calculation of the growth market rate. It is necessary to calculate how much the sales volume has increased/decreased in comparison with the previous period. To do this we need data on the sales for the previous period.

- The formula for calculating the growth market rate in Excel:* The percentage format is set for cells in column D.

- Calculation of the relative market share. For each of the analyzed products, you need to calculate the relative market share towards a similar product for a key competitor. To do this you have to divide the sales volume of the enterprise product by the sales volume of a similar product of the competitor.

Building the BCG matrix

The best tool for these purposes is a bubble chart in Excel.

Add the construction area to the sheet using the 'INSERT'-'Charts'-'Scatter'-'Bubble'. We enter the data for each line as follows:

After select: 'CHART TOOLS'-'DESIGN'-'Select Data'-'Add':

On the horizontal axis is the relative market share (set the logarithmic scale: 'CHART TOOLS'-'FORMAT'-'Current Selection'-'Horizontal (Value) Axis'). On the vertical is the rate of market growth. The area of the diagram is divided into 4 identical quadrants:

Central value for the growth market rate is 80%. For the relative market share is 1.00. We will distribute commodity categories taking into account these data:

Conclusions:

- 'Problems' - Item №1 and №4. Investments are needed to develop these goods. Scheme of development is next: creating a competitive advantage - distribution - support.

- 'Stars' - Item №2 and №3. The company has such categories and this is a plus. At this stage, only support is needed.

- 'Cash Cows' - Item №5. Brings a good profit which can be used to finance other products.

- 'Deadweight' is not found.

It is desirable to preserve this state of affairs as long as possible. Subsequently, we need to analyze the prospects of 'Difficult children' more deeply: is it possible to turn them into 'Stars'.

BCG Matrix of ITC

BCG Matrix also known as the growth-share matrix is used by organizations to classify their business units or products into 4 different categories: Dogs, Stars, Cash Cows and Question Mark.

Growth rate of an industry and the market share of a respective business relative to the largest competitor present in the industry are taken as the basis for the classifications, for that reason, BCG Matrix is also called as Growth-Share Matrix.

Dogs

These are the products with low growth or market share

These are low growth or low market share products and have very few chances of showing any growth.

The investment strategy for these products has to be very well thought through by the management as there are chances that these businesses might not yield any profit for the organization.

These business units or products are cash traps and therefore are not seen as a useful source of earning.

Cash Cows

These are the products which are in low growth markets with high market share.

Products which are market leaders in their specific industry and their industry is not expected to see any major growth in the future are considered as Cash Cows.

These products are the money churners for the company and require very low investments to sustain their leadership and profitability in the market.

Star

These are the products which are in high growth markets with a high market share.

Products or Business Units which hold a high market share and are also considered to grow in the future are positioned as Stars.

As a result, companies are interested to invest in developing these units further to gain a larger market share and attain a stronger position in the market.

These products have the potential of being positioned as cash cows in the future owing to the industry growth prospects.

Question Mark

Products in high growth markets with a low market share.

Products or business units of the company that are still in the nascent stage of their product lifecycle and can either become a revenue generator by taking the position of a Star or can become a loss-making machine for the company in the future.

The industry has high potential to grow hence giving the room to the products to grow as well only if the pertinent issues are managed effectively.

Let’s check out the BCG Matrix of ITC and what products of the company fall under what Quadrant.

Cash Cows:

Cashcows are the products that have a high market share in a market that has low growth. For ITC, there is one product that has undoubtedly been the Cash Cow and its FMCG Cigarettes.

Having a market share of 80-85 %, ITC Cigarettes holds a very strong hold in the market.

The product requires very less investment to maintain its market share and fight off any competition.

stars:

High market share product in high growth industry are considered Stars of the organization.

ITC’s paperboard and packaging business, Agribusiness and Hotels are the Stars of the organization.

Bcg Matrix Of Microsoft Company Information

Question Mark:

There are products that formulate a part of the industry that is still in the phase of development, yet the organization has not been able to create a significant position in that industry. The small market share obtained by the organization makes the future outlook for the product uncertain, therefore investing in such domains is seen as a high-risk decision.

With stiff competition and the growing demand for ayurvedic products has prompted ITC to go back to the drawing board, invest in R&D and look out for improvements in their products

Bcg Matrix Of Microsoft Company Information

ITC’s FMCG business, Personal Care business, are placed in the Question Mark quadrant of the BCG Matrix of ITC.

Decreasing market share due to new entrants to the market and the introduction of new ayurvedic products and their growing demand are the main reasons that these business units have become Question Marks.

DOGS:

Dogs are those products that were perceived to have the potential to grow but however failed to create magic due to the slow market growth.

Failure to deliver the expected results makes the product a source of loss for the organization, propelling the management to withdraw future investment in the venture. Since the product is not expected to bring in any significant capital, future investment is seen as a wastage of company resources, which could be invested in a Question mark or Star category instead.

ITC Infotech a specialized global full service IT consulting & outsourcing solutions provider focused on creating value for Supply Chain based Industries etc.

Heavy competition from the likes of Infosys, TCS, Accenture, HCL etc have led to a decrease in the market share of ITC Infotech and made it tough for the organization to survive in such tough market scenario.

Related Articles:

Read about the Brand Positioning of Samsung and understand its Segmentation, Targetting and Positioning

Learn about the Positioning of Apple and understand its Segmentation, Targetting and Positioning

What is Marketing Mix of Apple and how it’s helping in creating worlds most valuable brand?

What is the Marketing Mix of Amul?

Understand the Marketing Mix of Google and its 4ps of Marketing Mix.

Learn the BCG Matrix of Samsung and understand different business units which fall under different quadrants.

Learn the BCG Matrix of Nestle and understand different business units which fall under different quadrants.

Check out the BCG Matrix of Apple

Bcg Matrix Of Microsoft

What is the Marketing Mix of Nike

What is Marketing Mix of Samsung

Check out the Marketing Mix of Adidas

Learn more about the 4ps of Marketing Mix

Bcg Matrix Of Microsoft Company

Understand the BCG Matrix of Amul